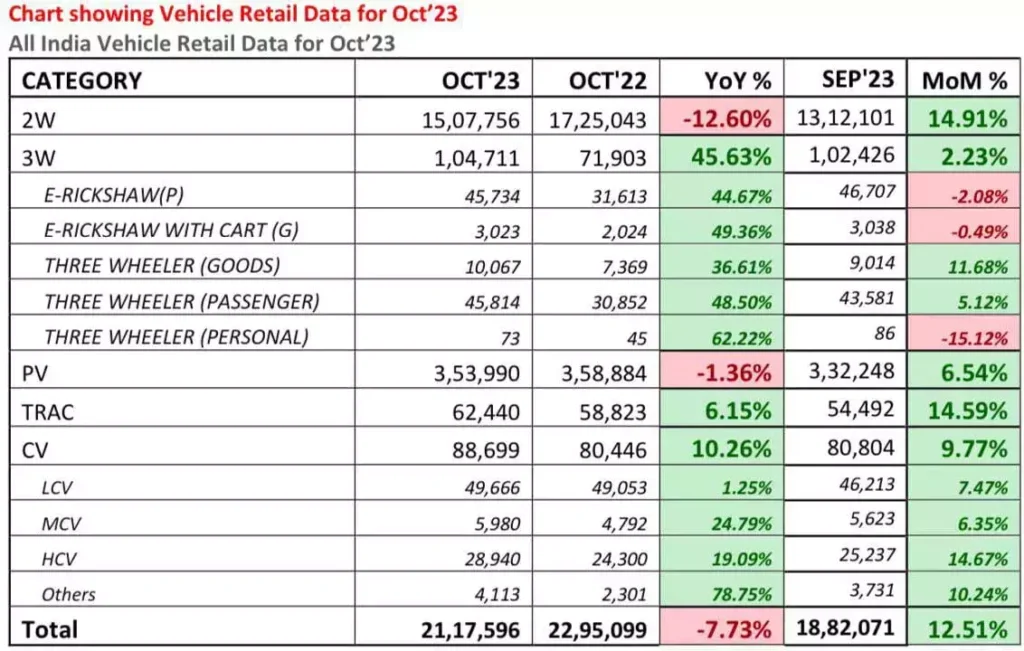

Retail Auto Sales Trends in October 2023

Retail auto sales in October 2023 witnessed a notable 13% increase compared to the previous month, although there was a 12.6% decline year-on-year, according to data released by the Federation of Automobile Dealers Associations (FADA). This surge in sales, particularly during the Navratri period, has shown positive signs for various segments within the automotive industry. However, concerns regarding high inventory levels in the passenger vehicle (PV) segment remain a focal point.

Overview of October Sales

The month of October began under the inauspicious Shraddh period, affecting year-on-year comparisons. However, the Navratri festivities in 2023 saw a remarkable 18% increase in sales compared to peak sales in 2017. Across categories, including two-wheelers, three-wheelers, passenger vehicles, tractors, and commercial vehicles, there was a collective growth, with two-wheelers and tractors showing particularly strong performance.

Concerns in the Passenger Vehicle Segment

While the overall sales trend appears positive, the passenger vehicle segment faces challenges. FADA’s survey indicates concerns about high inventory levels, currently standing at 63-66 days. The looming year-end discounts could further impact immediate sales, necessitating prompt attention from original equipment manufacturers (OEMs) to manage inventory effectively.

Potential Risks and Remedial Actions

FADA warns of potential dealer distress if immediate actions aren’t taken to address high inventory and mitigate financial risks. The industry faces the risk of unsold stock leading to wider repercussions, highlighting the need for decisive measures, especially with the year-end approaching.

Positive Trends in Other Segments

Despite challenges in the PV segment, other categories show resilience and positive growth. The two-wheeler category, buoyed by festive demand and rural sales, showcases promise. The three-wheeler segment, driven by finance options and e-Rickshaw interest, reflects a shift towards electrification. Commercial vehicles, particularly light and small ones, experience robust demand due to infrastructure projects and favorable finance schemes.

Regional Factors and Future Outlook

Regional variations, local elections, and market saturation impact sales dynamics. However, the anticipation of Diwali in November and the launch of new models sustain demand. Overall, the market shows adaptability and resilience, supported by improved product availability and consumer offers, signaling a dynamic yet cautiously optimistic landscape for the automotive industry in India.